Economist Carlota Perez talk about the future of ICT.

Category: policy – Page 81

US elections 2016: John McAfee and Zoltan Istvan debate cybersecurity, immortality and sexbots

This tongue-in-cheek article highlights an interesting experience I had a few days ago on the Immortality Bus in North Carolina:

One wants to live forever, the other wants to push reset on the US Constitution. Both are running for president in 2016. As Republican and Democrat presidential candidates prepare for December’s debates, pioneering Transhumanist Zoltan Istvan and cybersecurity legend John McAfee met for the first time this week for their own debate, over several large drinks in a motel bar.

Istvan, who is currently touring the US aboard a coffin-shaped campaign bus, and McAfee both have technology at the core of their campaign policies, but in terms of specific policy this is where the similarities end.

“I can’t think of a more horrific concept than immortality,” McAfee told Istvan soon after meeting in Charlotte, North Carolina. “It is anti-evolutionary. We need to die and die young preferably; dying is the most beautiful of all things. I’d get behind a platform where you kill everyone at 30. I would fight you tooth and nail to stop you making people live forever.”

France votes to give government powers to block online communications during state of emergency — By Paul Sauers | VentureBeat

“French members of parliament (MPs) have voted to give the government extra powers to block online communications when the country is under a “state of emergency.””

Apple to Introduce 100% Solar-Powered Retail Store

Tech behemoth Apple is set to become the first completely solar-powered company in Singapore.

As part of a long-term partnership with Sunseap Group, Apple will draw upon Sunseap’s vast network of more than 800 solar panel-equipped buildings, which will satisfy the energy requirements for the company’s forthcoming 2,500-person corporate campus and retail store operations in Singapore.

According to Lisa Jackson, Apple’s vice president of Environment, Policy and Social Initiatives, the company aims to completely kick its dependence on fossil fuels and rely instead on renewable energy sources for its facilities worldwide.

Space Mining Bill Passes In Congress

According to international treaties, no country is allowed to own things like moons or asteroids. But what about a company?

A new bill would allow space mining companies to own pieces of space. Although they couldn’t own a whole asteroid, for example, the bill would ensure that space mining businesses would legally own the resources they extract from that asteroid.

Last week the bill passed in the Senate with a few amendments, and yesterday those amendments were accepted in the House of Representatives. Now the bill is off to the Oval Office, where space policy experts predict President Obama will sign it into law.

Bikk McKibben on Obama’s Keystone XL Rejection: ‘The Tide Is Starting to Turn’ — By Tessa Stuart | Rolling Stone

“McKibben calls Friday’s announcement a turning point in the fight against climate change”

China to end one-child policy and allow two

China decides to end its decades-long policy of allowing couples to have only one child, increasing the number permitted to two.

Humanity on a Budget, or the Value-Added of Being ‘Human’

This piece is dedicated to Stefan Stern, who picked up on – and ran with – a remark I made at this year’s Brain Bar Budapest, concerning the need for a ‘value-added’ account of being ‘human’ in a world in which there are many drivers towards replacing human labour with ever smarter technologies.

In what follows, I assume that ‘human’ can no longer be taken for granted as something that adds value to being-in-the-world. The value needs to be earned, it can’t be just inherited. For example, according to animal rights activists, ‘value-added’ claims to brand ‘humanity’ amount to an unjustified privileging of the human life-form, whereas artificial intelligence enthusiasts argue that computers will soon exceed humans at the (‘rational’) tasks that we have historically invoked to create distance from animals. I shall be more concerned with the latter threat, as it comes from a more recognizable form of ‘economistic’ logic.

Economics makes an interesting but subtle distinction between ‘price’ and ‘cost’. Price is what you pay upfront through mutual agreement to the person selling you something. In contrast, cost consists in the resources that you forfeit by virtue of possessing the thing. Of course, the cost of something includes its price, but typically much more – and much of it experienced only once you’ve come into possession. Thus, we say ‘hidden cost’ but not ‘hidden price’. The difference between price and cost is perhaps most vivid when considering large life-defining purchases, such as a house or a car. In these cases, any hidden costs are presumably offset by ‘benefits’, the things that you originally wanted — or at least approve after the fact — that follow from possession.

Now, think about the difference between saying, ‘Humanity comes at a price’ and ‘Humanity comes at a cost’. The first phrase suggests what you need to pay your master to acquire freedom, while the second suggests what you need to suffer as you exercise your freedom. The first position has you standing outside the category of ‘human’ but wishing to get in – say, as a prospective resident of a gated community. The second position already identifies you as ‘human’ but perhaps without having fully realized what you had bargained for. The philosophical movement of Existentialism was launched in the mid-20th century by playing with the irony implied in the idea of ‘human emancipation’ – the ease with which the Hell we wish to leave (and hence pay the price) morphs into the Hell we agree to enter (and hence suffer the cost). Thus, our humanity reduces to the leap out of the frying pan of slavery and into the fire of freedom.

In the 21st century, the difference between the price and cost of humanity is being reinvented in a new key, mainly in response to developments – real and anticipated – in artificial intelligence. Today ‘humanity’ is increasingly a boutique item, a ‘value-added’ to products and services which would be otherwise rendered, if not by actual machines then by humans trying to match machine-based performance standards. Here optimists see ‘efficiency gains’ and pessimists ‘alienated labour’. In either case, ‘humanity comes at a price’ refers to the relative scarcity of what in the past would have been called ‘craftsmanship’. As for ‘humanity comes at a cost’, this alludes to the difficulty of continuing to maintain the relevant markers of the ‘human’, given both changes to humans themselves and improvements in the mechanical reproduction of those changes.

Two prospects are in the offing for the value-added of being human: either (1) to be human is to be the original with which no copy can ever be confused, or (2) to be human is to be the fugitive who is always already planning its escape as other beings catch up. In a religious vein, we might speak of these two prospects as constituting an ‘apophatic anthropology’, that is, a sense of the ‘human’ the biggest threat to which is that it might be nailed down. This image was originally invoked in medieval Abrahamic theology to characterize the unbounded nature of divine being: God as the namer who cannot be named.

But in a more secular vein, we can envisage on the horizon two legal regimes, which would allow for the routine demonstration of the ‘value added’ of being human. In the case of (1), the definition of ‘human’ might come to be reduced to intellectual property-style priority disputes, whereby value accrues simply by virtue of showing that one is the originator of something of already proven value. In the case of (2), the ‘human’ might come to define a competitive field in which people routinely try to do something that exceeds the performance standards of non-human entities – and added value attaches to that achievement.

Either – or some combination – of these legal regimes might work to the satisfaction of those fated to live under them. However, what is long gone is any idea that there is an intrinsic ‘value-added’ to being human. Whatever added value there is, it will need to be fought for tooth and nail.

Global Scenarios and National Workshops to Address Future Work/Technology Dynamics are being scheduled by The Millennium Project | PRWeb

“The nature of work, employment, jobs, and economics will have to change over the next 35 years, or the world will face massive unemployment by 2050. This was a key conclusion of the Future Work/Technology 2050 study published in the “2015−16 State of the Future.””

What if U.S. had raised interest rates?

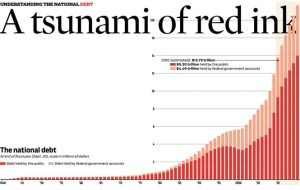

At the end of 2015, the US national debt will be 18.6 trillion dollars. With such a big number, it’s tempting to put it in perspective by comparing it with things more easily envisioned. Alas, I can not think of anything that puts such an oppressive and unfair burden into perspective, except to this:

US debt represents a personal obligation of $60,000 for each American citizen. And it is rising quickly. Most of our GDP is used simply to pay down interest on that debt. Few pundits see a way out of this hole.

In my opinion, that hole was facilitated in August 1971, when the US modified the Bretton Woods Agreement and unilaterally terminated convertibility of the US dollar to gold. By forcibly swapping every dollar in every pocket and bank account with the promise of transient legislators, individual wealth was suddenly based on fiat instead of something tangible or intrinsic.

In my opinion, that hole was facilitated in August 1971, when the US modified the Bretton Woods Agreement and unilaterally terminated convertibility of the US dollar to gold. By forcibly swapping every dollar in every pocket and bank account with the promise of transient legislators, individual wealth was suddenly based on fiat instead of something tangible or intrinsic.

Feds Meet: No interest rate hike

The benchmark interest rate set by the US Federal Reserve Board is currently between 0 and 0.25%. It has been at or near zero since 2006.

By now, Lifeboat readers know that 20 hours ago, the US Federal Reserve board decided to not hike the benchmark interest rate. The Fed did, however, signal that they still intend to raise interest rates at a future meeting—perhaps in October or December.

The announcement came just after US equity markets closed. But, in what has become a most odd news coverage of a non-event, the immediate reaction was to lift the Asian stock markets, which were still open during the announcement.

I am a frequent contributor to Quora. I field many questions on economics, politics, law, and even physics. You might be inclined to check out my credentials as pundit of macro-economics. Don’t bother…There are none! I am an armchair economist (this is the same as saying: “I am not an economist”). But I certainly follow these things closely, and have an informed opinion.

Today, I was asked this:

What would happen if the fed had raised interest rates?

The question asked specifically about the effect on other interest rates, but a more interesting exercise might be to speculate on the state of the economy. Here then, is a comon-sense response…

If we could freeze all other conditions and avoid the effects of public confidence, likely change in debt, debt rating, etc… If we ignore these things, then the direct result of raising the interest rate for a given national currency is to attract outside money. That is, we would see an increase in foreign conversion into dollars and a movement of US assets from stocks and bonds into currency or currency equivalents. This is a simple result of the higher payout that one would expect after a raise in interest rates.

In theory, the sift of international assets and investment into dollars does four things:

- It strengthens the value of the dollar, thereby increasing the take-home potential of US workers and the number of things US residence buy from overseas (because a slightly higher fraction of organizations seek dollars)

- It increases income for anyone tied to published interest rates, such as many senior citizens.

- It increases interest payments from anyone tied to published interest rates. For anyone deeply in debt on instruments such as credit cards or home equity, this can have a devastating impact—causing minimum payments to rise by many times the interest rate hike.

- It increases US national debt, because so much of the economy is built on forward loans in the form of Treasury notes. With an interest rate increase, the US must pay more on both new debt and the financing of massive outstanding debts.

This is all theoretical, of course. In practice, one of the first effects is for individuals and institutions to wonder: “How can the US possibly pay out on debt at an increased rate?”. [possible answer]*

One very obvious effect is that many individuals will further lose confidence in the American economy or the will of American’s to honor the national debt. Because of this, the effect of raising the interest rate (for the first time in 9 years) is not easy to predict. Despite massive uptake on US debt, the Chinese and energy producing nations have limits to what they can believe. A subtle switch in their investment activity (or the determination to move away from a dollar-based reserve) will have massive repercussions, especially for the US.

_____________

* Some pundits argue that US debt and payments can continue to grow, because the ability to accommodate these things are protected by these things:

- a recovering economy

- increased activity from the new investors

- need for producer nations to seize on a massive consumer market

- need for producer nations to invest their gains

But, a growing number of economists, investors, analysts, credit bureaus, and citizens don’t buy this argument! They point out that it kicks-the-can down the road and foists untenable debt on future generations. They would prefer that the US reign in spending and pay down debt.

In this regard, being the world’s reserve currency has helped hook the US on debt, and it has ballooned out of control. Transitioning to a firmly capped currency that is not controlled by legislation or a reserve board would help the country avoid massive debts (those that exceed the willingness of bond holders to finance) and to do what it must do.

In my take, the real question is not “What if the Fed has raised interest rates?” The real question is:

Does the U.S. have the courage to link its currency to something durable

— and beyond control of transient political winds and a debt pyramid?”

Sure, we must still honor the excess of the past 40 years. But with gold, or Bitcoin, at least we will have solid underpinnings and incentives to spend within our means.

Philip Raymond is a member the New Money Systems Board

at Lifeboat. He is Co-chair of Cryptocurrency Standards

Association and editor at A Wild Duck.