Archive for the ‘cryptocurrencies’ category: Page 46

Mar 5, 2019

Coinbase Preventing Account Closures as #DeleteCoinbase Movement Spreads

Posted by Steve Nichols in categories: bitcoin, cryptocurrencies

Multiple users are reporting on social media that they are currently unable to delete their Coinbase accounts. This news comes as some cryptocurrency enthusiasts continue to clamor for a boycott of the exchange giant over its recent acquisition of Neutrino.

Amid the clamor for a boycott on Coinbase, some users are saying that the company is preventing them from closing down their accounts. Respondents say they followed the fairly easy account closing procedure only to be met with error messages.

Continue reading “Coinbase Preventing Account Closures as #DeleteCoinbase Movement Spreads” »

Feb 28, 2019

Get ready for a Facebook-sponsored cryptocurrency

Posted by Genevieve Klien in category: cryptocurrencies

Feb 25, 2019

Chinese internet users turn to the blockchain to fight against government censorship

Posted by Genevieve Klien in categories: bitcoin, cryptocurrencies, government, internet

Thanks to blockchain, internet users have achieved some victories in the fight against China’s strict internet censorship.

A historic moment was made on April 23. Peking University’s former student, Yue Xin, had penned a letter detailing the university’s attempts to hide sexual misconduct. The case involved a student, Gao Yan, who committed suicide in 1998 after a professor sexually assaulted and then harassed her.

The letter was blocked by Chinese social networking websites, but an anonymous user posted it on the Ethereum blockchain.

Feb 19, 2019

Once hailed as unhackable, blockchains are now getting hacked

Posted by Quinn Sena in categories: bitcoin, cryptocurrencies, security

More and more security holes are appearing in cryptocurrency and smart contract platforms, and some are fundamental to the way they were built.

Feb 18, 2019

How J.P. Morgan’s fake cryptocurrency threatens SWIFT, Western Union and Deutsche Bank’s real business.

Posted by Samson Williams in category: cryptocurrencies

Last week JP Morgan announced that it had developed its own cryptocurrency, the“JPMCoin”. Lost in the much of the noise about whether or not the JPMCoin is a real blockchain or cryptocurrency is the fact that, for mainstream blockchain adoption, the announcement is a big deal. Don’t get me wrong. The JPMCoin is no more a cryptocurrency than say Fortnight’s V-Bucks or your airline miles are. However, for blockchain the technology (even if JPMorgan isn’t actually using a blockchain) the mere mention of the possibility that blockchain like tech is being adopted by the 6th largest bank in the world, a meaningful way, is a big step towards mainstream adoption.

As you consider this here are a few points you can confidently share with your colleagues and friends:

- The #JPMCoin isn’t a #blockchain or a #cryptocurrency

- That doesn’t matter because JPMorgan’s modern day #DigitalAbacus does solve real business problems and proposes real operational cost savings, aka revenue generators

- #Swift, #WesternUnion & #DeutsheBank should be concerned because when the worlds 6th largest bank adopts a means of saving X% on #settlement, #creditcard, #remittance and #banktransfers this could directly cut into their core revenue streams

- Because JPMorgan didn’t adopt #blockchainlike technology for accounting, for the greater good of transparency, trust, blah blah blah

- They did it for operational efficiencies that would translate into revenue 6 Coincidentally, Ripple rejoices! As the #JPMCoin validates their entire business model as only the 6th largest bank in the world can.

Too, JPM’s entry into the internal/private permissioned psuedo #blockchainworld of operational efficiency disrupts Ripple’s competitors. This is a blessing for Ripple, as it is easier to take down a global banking middlemen (Swift) if another global banking titan (JPMorgan) decides it wants to cannibalize its fellow banking middleman.

In conclusion, if you look beyond the hype you’ll see a landscape of operations & technology innovations, with incremental process improvements that = real $$$$. Too, you’ll see an international chess board where the major players are strategically positioning their businesses to take advantage of the most efficient (profitable) and complementary services available. Stay tuned. Blockchain in finance and banking is just getting started. Next, regulatory hurdles.

Feb 6, 2019

The Indian government is worried that cryptocurrencies may destabilise the rupee

Posted by Steve Nichols in categories: cryptocurrencies, government

Feb 4, 2019

Canadian cryptocurrency fund boss Gerald Cotten died – and US$190million of his investors’ money may be encrypted forever

Posted by Michael Lance in categories: cosmology, cryptocurrencies, economics, encryption

US$190 million in investors’ money has been locked since Cotten died in December. His widow says she doesn’t know his passwords.

About US$190 million in cryptocurrency has been locked away in a online black hole after the founder of a currency exchange died, apparently taking his encrypted access to their money with him.

Investors in QuadrigaCX, Canada’s largest cryptocurrency exchange, have been unable to access their funds since its founder, Gerald Cotten, died last year.

Feb 4, 2019

The DIY designer baby project funded with Bitcoin

Posted by Klaus Baldauf in categories: bioengineering, bitcoin, cryptocurrencies

Jan 22, 2019

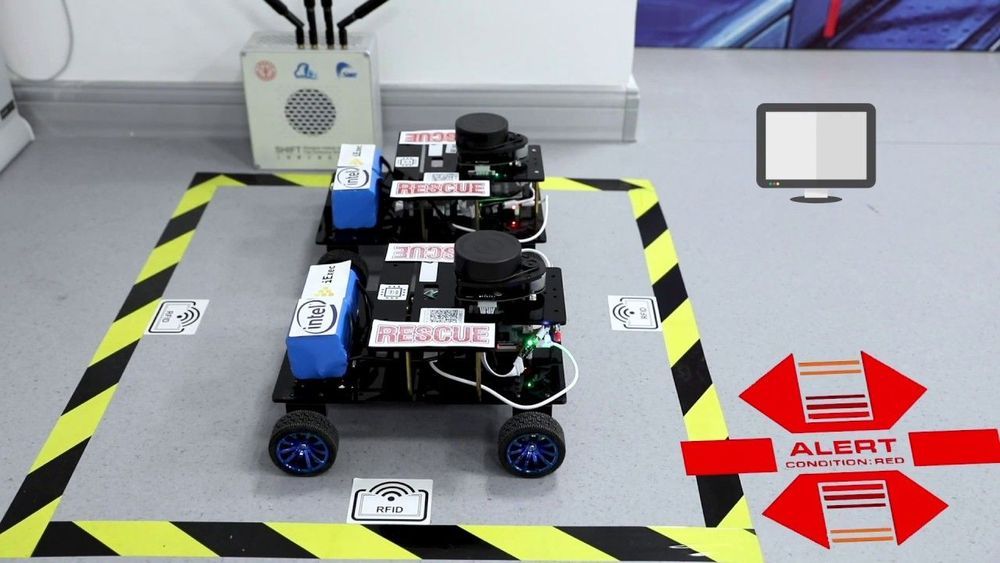

Announcing Hyperledger Grid, a new project to help build and deliver supply chain solutions!

Posted by Caycee Dee Neely in categories: bitcoin, computing, cryptocurrencies

While I’m not a big supporter of cryptocurrency, I am a supporter of utilizing blockchain technology in other areas. For example. logistics. The Linux Foundation announced the creation of the Hyperledger Grid project just for that purpose. However, as they state, this isn’t a software project, but a platform project.

Supply chain is commonly cited as one of the most promising distributed ledger use-cases. Initiatives focused on building supply chain solutions will benefit from shared, reusable tools. Hyperledger Grid seeks to assemble these shared capabilities in order to accelerate the development of ledger-based solutions for all types of cross-industry supply chain scenarios.

Grid intends to: