Getting Apple, Microsoft and Fortune-500s to Uninterruptedly Buy From You!

Apple, Berkshire Hathaway Corporation, Mitsubishi Motors, Honda, Daimler-Chrysler’s Mercedes-Benz, Toyota, Royal Dutch Shell Oil Company, Google, Xerox, Exxon-Mobil, Boeing, Amazon, Procter & Gamble, NASA and DARPA, Lockheed Martin, RAND Corporation and HUDSON Institute, Northrop Grumman Corporation, GEICO, Microsoft, etc.

FOREWORD:

You are going to need to prepare thyself breathtakingly. You will need a Brioni suit and a silk tie and understand, later on below this material, how to get lucky via Rampant Rocket Science.

FIRST. You fully study the corporation’s story and current culture and lexicon. You always study about their own problem-solving methodologies, proprietary or otherwise.

SECOND. You fully study the corporation’s financial and legal and compliance and tax standing.

THIRD. If the corporation is publicly traded, you strongly look into this.

FOURTH. You fully study the corporation’s industry and all of its competitors.

FIFTH. If the industry to which belongs the designated corporation is facing an extraordinary unforeseen wicked challenge, make a long executive presentation for the middle-management executives and the supervisory-level staff, fully acknowledging the details of said challenge and suggesting, as per authoritative authors in the subject matter, a well-organized myriad of viable fundamental solutions.

At all times, you are to make this executive presentation like a presentation to a sacred university professor and classroom, hence an institutional one only, and not a marketing one at all, as you objective is to break the ice and establish a Golden Bridge of Communication and Mutual Trust with your targeted corporate client, ONLY through meaningfulness, utility, relevance, and purposefulness.

In no slide you would mention your name, but in your solemn business cards.

Throughout this executive presentation, you will NEVER be addressing any theme natural to your Core Business’ Products and/or Services, but in your solemn business cards.

AN EXTRAORDINARY UNFORESEEN WICKED CHALLENGE, SOLVED, AND BANKED ON.

I will give you a real-life example of an extraordinary unforeseen wicked challenge. I had a new company, acting as a Health Maintenance Organization (HMO).

I was looking for institutional clients, both from the private sector and public sector. Every time I had a conversation with a prospective client, he would ask about my prior clients and ask,

“…Andres, are you going to run an experiment with my company and its employees without firm grounds …”

Then, I paid huge attention to Mr. Jim Rhon (ISBN: 978–0983841593), and his wise sentence, “…you become [professionally and business] attractive [to the many clients in the marketplace], I then found a turnaround, perhaps a breakthrough.

As an HMO I was competing with Insurance Companies that were, at the time, presenting universal insolvency in paying healthcare claims to those insurance employees covered by and through the employer’s payroll.

Across many industries, the most-important employers’ employees were getting unnecessarily ill and even dying as the insurance companies were not paying for their “covered” medical expenses.

Accordingly, I decided to make myself the ultimate master in Public and Private Insurance Systems and Beyond and in any organizational device, paying (indemnity payments) for healthcare claims.

AND TO ILLUSTRATE THE PRACTICAL NOTION OF THE “…ULTIMATE MATTER…,” NAPOLEON BONAPARTE OBSERVED:

Napoleon Bonaparte asserted, “…I have only one counsel for you ― be master [.…] No longer it is question simply of education, NOW IT BECOMES A MATTER OF ACQUIRING [HARD] SCIENCE …” Brackets are of the author.

END OF NAPOLEON’S THOUGHT.

I took several airplanes and went up and researched everything by the World Health Organization, the private and public sectors of the U.S., Canada, U.K., and some Scandinavian countries.

As a little part of that, I litmus-test every upside and downside by every Social Security program and Healthcare Safety Net System.

As I saw and understood everything under the Sky, I made myself a world-class erudite on the subject. So, I started sending FEDEX letters to the Chief Public Affairs Offices of the largest prospective clients I want for my tiny company.

These prospective largest clients have to be big in order to have a sufficient knowledge level to transcend the old-snailed insurance company notion.

I gave them a breathtaking academic business presentation, covering every Macro Aspect through every Nano Aspect, through facilitating, step-by-step plausible solutions for each one of them.

ITEM “A” (WITHIN THE “FIFTH” NUMBER).- At the end of each business presentation, they could not believe the sophistication level of my rendition.

In fact, several stated, “…Mr. Agostini, your [pro bono] presentation and academic lecture we must pay well to you…”

ITEM “B” (WITHIN THE “FIFTH” NUMBER).- Out of each ten prospective clients and because of the preceding business presentation, I got eight (8) huge clients.

ITEM “C” (WITHIN THE “FIFTH” NUMBER).- You cannot believe the level of “…courtesy extension …” they gave me once I had completed my business presentation.

Each attendee got a white envelope with CDs and organized printed materials, accounting to over 400 top-notch researched bibliographical references, those bibliographical references that at the onset underpinned my business presentation into business making.

I gave them, each, ten (2) extra packages for all of the authorities, including, in some cases, employers’ union top representatives. Ten (10) extra packages to Chief PR Officer for all of the c-level authorities.

Ergo, now, you have to pick an extremely wicked problem for your designated prospective client, it could be one outside of the client’s core business, and adapt my account above to your own reality in dealing with said perspective client.

Use these techniques and you will be impressed. Please remember to dress up extremely well and proper.

COMMENTARY TO FIFTH. Why does it have to be a long executive presentation? I will respond through Napoleon Bonaparte’s best practices, best practices to seizing success continually.

Every time a General (Manager) under his Command would give him a one-page letter (memo, slide), Napoleon would say to his General in question,

“…General (Manager), you are to wage [to launch] a grave military campaigns [a complicated business initiative] full of mechanics, dynamics and details … Subsequently, I want to KNOW everything at all in advance, every detail at all, large or tiny or fuzzy, in order for me to issue my most-detailed commanding plans for your campaign victory [that is: your triumph in the corporate theater of operations in the global marketplace]…”

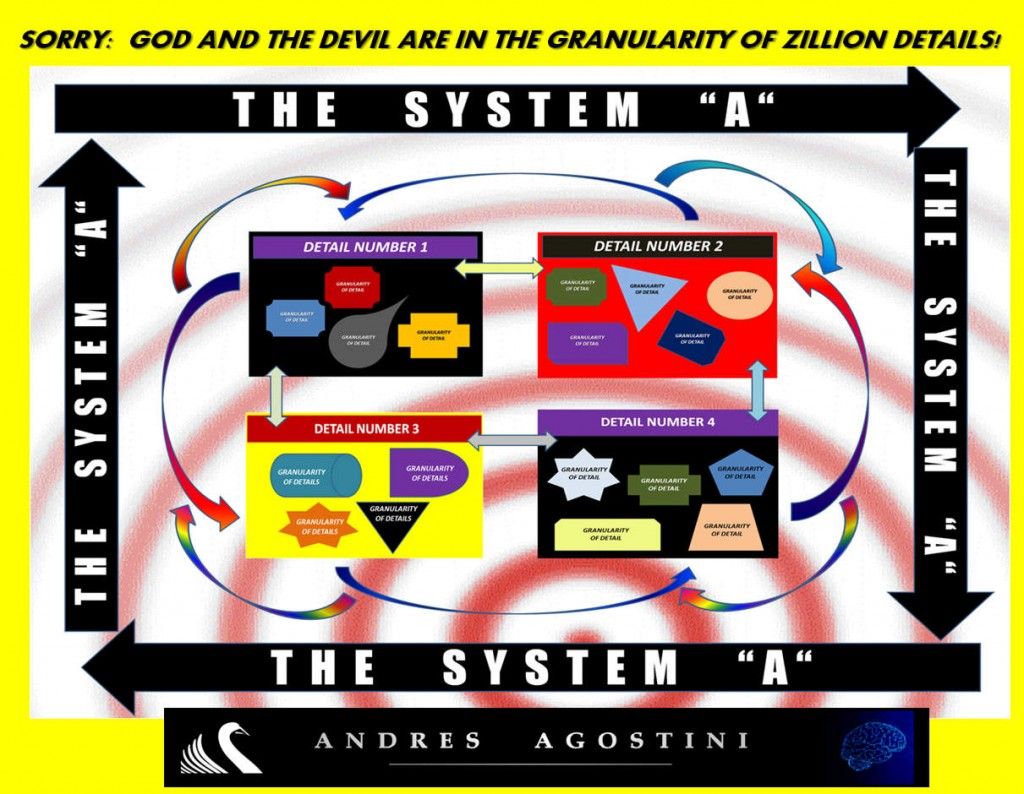

To further underpin the Napoleonic motion above, William Gates III (Bill Gates), through his book Business @ the Speed of Thought: Succeeding in the Digital Economy (ISBN: 978–0446525688), makes the case not for the relevance of “…details…”, but for the «sine qua non» vitality of “…The Granularity of Details …”

Frequently, Napoleon would dishonorably discharge this General (Manager) or have his head role for incompetence, incompetence is another word for people with a Mind “Engaged” in worshiping The Least Mental Effort, thus repudiating the “extra mile” effort.

There is too much noise about employees complaining about their bosses, but not about competent bosses complaining about their mediocre employes.

Clearly, Napoleon, during his life time and early on, heavily warns against Corporate America CEOs wanting JUST a 1-page memo delivered via email.

SIXTH. Then, you call the prospective corporate client’s P.R. person Or Communications officer and tell them about what you would like to do.

You send a letter with a summary of your presentation via FEDEX. They will give you a time and board room for your presentation, to be received by the corporation’s middle-level and supervisory-level management workers.

SEVENTH. Once you drive you car to the corporation’s office, pay extreme attention to (first) the lower-level security personnel, (second) the front-desk receptionist, and, if possible, and (third) to the great janitorial staff.

Get extremely respectful with them and treat them as the Chairman and become a bit friendly as you try to get the company’s organizational ethos by and through the lower-level security personnel, the front-desk receptionist, and the great janitorial staff.

Listen and mind-record their word types and wording construes most carefully.

In my case, by observing the front-desk receptionist for ten (10) minutes, I can tell you exactly what type of corporate culture there is about I am coping with, much more importantly than those confidential underground reports by Wall Street Bankers and Traders.

EIGHT. Before starting the executive presentation, say to the audience that you would like to introduce yourself to each one of them and shake their hands, to bring about much more psychological proximity and fore-acceptance.

Then, explain the order of your executive presentation. Second, with great care, deliver the presentation without attacking people, institutions, or even ideas.

Use, with extreme care and utility, their parlance and corporate culture at all times while you get, from A to Z, very solemnly.

Once you have thoroughly and calmly finished your executive presentation, use the Lee Iaccoca’s golden rule and state,

“ …Okay, we have completed this executive presentation and through it we saw this, that, x, y, z,…” in a summarized way.

Give them now boundaryless time and psychological space to ask you zillion questions — weird, stupid, or savvy — in the Q-and-A.

Ascertain to respond fully, accurately, on the point and with NONE MANIPULATION at all.

Take each of this business presentation an occasion to give extreme accuracy and examples of what you mean through said no-manipulation and accuracy.

In fact, tell them, AT ALL TIMES, the truths and solutions, as per your deepest and most updated research, that they did not know about it. In doing this, be extremely solemn and on the point with kindness and respect.

If there is something that you do not know, tell them, research the answer fully, and get back with the answer via a FEDEX-ed hard-copy.

Once you have responded all of the questions, give them an exact copy of the Executive Presentation, with the additional attachment of the authoritative literature you used in your evidence-based research.

Do this in hard-copy only and put it a nice white envelope. You give one package to each attendee and give the P.R. Manager three or four more for the CEO and the Board Members.

NINE. If you followed through to ULTIMATE PERFECTION, points #1 through #8, step by step, you will see them ask you something along these lines,

“…Okay, Mr. _X_, we like you evidence-based research and executive presentation and wonder who in the marketplace could offer these solutions to us …”

Without being or sounding desperate, you will say quickly and softly, “… Our Company can fully take care of those for you …”

And the idea now is that you go from a Pro Bono Executive Presentation into a formal for-business conversation with your prospective corporate client.

As the formal conversation begins, as per my long experience, tell them kindly that in parallel you want to soon fulfill the corporation’s Guidelines entirely to become a Registered Contractor as per your company’s Lines of Professional Practice.

If you want to do this procedure with, say, Apple Inc., pay attention to the following:

Register with the Supplier (Contractor) Information Database at https://www.apple.com/procurement/

AND ALSO:

http://www.apple.com/supplier-responsibility/

AS WELL:

http://images.apple.com/supplier-responsibility/pdf/Apple_SR…Report.pdf

Also in parallel, ask the mid-level managers that you are formally talking to that you would like to gain more organizational familiarity by doing incommensurable listening and some small talk with lower-level employees, including the lower-level security and janitorial staff.

Put in writing, to the PR executive, a detailed overview and hand to him or her personally.

Sometimes these folks know the corporation better than the CEO. At all times and by now, be beyond ready to be called upon to meet the Chairman, CEO, or other Board Members.

THEN, FOLLOW THROUGH THESE PRACTICAL TENETS CONDUCIVE TO OUTRIGHT VICTORY:

(1.- of 20).- If you want to seize the undivided attention of top executives at Los Alamos National Laboratory and Procter & Gamble, TALK TO THEM THROUGH THE NOTIONS OF AND BY Process Re-engineering.

(2.- of 20).- If you want to seize the undivided attention of top executives at GE, TALK TO THEM THROUGH THE NOTIONS OF AND BY Six Sigma, and Peter F. Drucker’s Management by Objective (MBO). While you are with them, remember to commend on the Jack Welch’ and Jeff Immelt’s master lectures at GE’s Crotonville.

(3.- of 20).- If you want to seize the undivided attention of top executives at RAND Corporation and HUDSON Institute, TALK TO THEM THROUGH THE NOTIONS OF AND BY Herman Khan’s (Dr. Strangeloves’) Scenario Methodology.

(4.- of 20).- If you want to seize the undivided attention of top executives at Mitsubishi Motors and Honda and Daimler-Chrysler’s Mercedes-Benz and Maytag, TALK TO THEM THROUGH THE NOTIONS OF AND BY Kaizen.

(5.- of 20).- If you want to seize the undivided attention of top executives at NASA and DARPA and the Industrial-Military Complex, TALK TO THEM THROUGH THE NOTIONS OF AND BY Systems Approach with the Perspective of Applied Non-Theological Omniscience.

And, also, Want to get funded by DARPA? How? The pathway is extremely easy and promissory. Just give them an unimpeachable real-life demonstration of how to “violate” the Universe’s Laws of Physics correctly and frequently, for Life!

(6.- of 20).- If you want to seize the undivided attention of top executives at Lockheed Martin, TALK TO THEM THROUGH THE NOTIONS OF AND BY Mean, Agile, Lean, Six Sigma, and Skunk Works.

(7.- of 20).- If you want to seize the undivided attention of top executives at Toyota, TALK TO THEM THROUGH THE NOTIONS OF AND BY Toyota Production System (methodology). Please remember: TPS is also known as “…Thinking People System…” (ISBN: 978–0071392310).

(8.- of 20).- If you want to seize the undivided attention of top executives at Royal Dutch Shell, TALK TO THEM THROUGH THE NOTIONS OF AND BY Pierre Wack’s Scenario Methodology (http://www.economist.com/node/12000502).

While at it and with them, pay colossal tribute to Royal Dutch Shell Group Planning by Pierre Wack, Ted Newland, and Peter Schwartz.

(9.- of 20).- If you want to seize the undivided attention of top executives at Mayo Clinic, TALK TO THEM THROUGH THE NOTIONS OF AND BY Dr. Joseph Juran’s (Total Quality Assurance) Prescription (ISBN: 978–0787900960).

Also remember to conjointly speak, at all times, of efficiency, productivity, and ROI as it stems in the incessant real-time reckoning of man-hours per patient cured and healed, transforming the dying into well-being people.

To this end, you might wish to peruse this great title: The Essential Drucker: The Best of Sixty Years of Peter Drucker’s Essential Writings on Management by Peter F. Drucker (ISBN: 978–0061345012).

(10.- of 20).- If you want to seize the undivided attention of top executives at Google, TALK TO THEM THROUGH THE NOTIONS OF AND BY Strong Quantum Supercomputing and Human-Death Reverse-Engineering, as well as utterly Curing Human Death.

Google will attained this canonical milestone through Calico (The name Calico is shorthand for California Life Company). Calico is an independent R&D biotechnology company established in 2013 by Google Inc., whose goal is to preemptively tackle the process of aging.

More specifically, Calico’s plan is to use advanced technology to increase understanding of the biology that controls lifespan, and to use that knowledge to increase longevity and cure human death.

Google’s electric driver-less car, among other amenities, will be achieved by a moon-shooting subsidiary, meaning “…Google Extreme,…” seriously known as: Google X and his Chief Scientist Officer to “…change the World,…” Dr. Astro Teller.

(11.- of 20).- If you want to seize the undivided attention of top executives at Xerox, TALK TO THEM THROUGH THE NOTIONS OF AND BY PARC (Palo Alto Research Center Incorporated).

(12.- of 20).- If you want to seize the undivided attention of top executives at Rockefeller’s ExxonMobil, TALK TO THEM THROUGH THE NOTIONS OF AND BY Efficiency and Productivity as well as the notions of and by Return On Investment (ROI) per Petroleum Barrel produced (outputted), and Project Management.

(13.- of 20).- If you want to seize the undivided attention of top executives at Boeing, TALK TO THEM THROUGH THE NOTIONS OF AND BY Aerospace Engineering, Avionics, Systems Engineering, Reliability Engineering, Safety Engineering, Industrial Engineering, and Mechanical Engineering.

(14.- of 20).- If you want to seize the undivided attention of top executives at SETI (Search for Extra-Terrestrial Intelligence), TALK TO THEM THROUGH THE NOTIONS OF AND BY Super-intelligence entrenched, in “… plain sight…,” in the covert «…ad infinitum …» realm of Dark Energy and Dark Matter.

(15.- of 20).- If you want to seize the undivided attention of top executives at Loyd’s of London, GEICO, Swiss RE, Munich RE, and Allianz, TALK TO THEM THROUGH THE NOTIONS OF AND BY Minimax, Statistics, Actuarial Science, Predictive Analytics, and Systems Engineering.

(16.- of 20).- If you want to seize the undivided attention of top executives at Amazon, TALK TO THEM THROUGH THE NOTIONS OF AND BY Low-Cost And High-End Online Commerce, Content Creation, Hi-Tech, Cloud Computing, Quadcopters (Commercial Flying Drones), and Eternal Staggering Innovation. Don’t forget to mention the artificial sage, namely the “… Mechanical Turk …”

(17.- of 20).- If you want to seize the undivided attention of top executives at Northrop Grumman Corporation, TALK TO THEM THROUGH THE NOTIONS OF AND BY State of the Art: Quality, Continuous Improvement, Customer Satisfaction, Leadership (Man-Management and Statesmanship), Integrity, People, Suppliers, Sound Business Management, “…Best in Class…” Products and Services, and how to preemptively countermeasure Chinese penetrations and otherwise of both commercial and government networks in the United States.

(18.- of 20).- Then, you want to do business with the Oracle of Omaha’s Berkshire Hathaway Inc. Right? You want to get his undivided attention to offer him your professional services and seize him as your cash-paying institutional client.

If this is the case, you need to send a shrewd clear-eyed missive to Warren E. Buffett’s Mr. Charlie Munger, Business Magnate and Vice-Chairman of Berkshire Hathaway Corporation and Warren’s second best friend, after Bill Gates, number one.

You use the best stationary (at least 25% made of cotton) you can use and your proposal is to be sent, under the most expensive priority, via FEDEX, with a white envelope, to:

The Most Honorable Mr. Charlie Munger

Vice-Chairman

Berkshire Hathaway Corporation

3555 Farnam Street

Suite 1440

Omaha, NE 68131

(402) 393‑7255 (double check)

Through that letter, you mention seven lines of the wisdom you have gotten from Warren’ and Bill’s favorite book lists, book by book, as follows:

Business Adventures: Twelve Classic Tales from the World of Wall Street by John Brooks

ISBN: 978–1497644892

Essays In Persuasion by John Maynard Keynes

ISBN: 978–1441492265

The Theory of Investment Value by John Burr Williams

ISBN: 978–0870341267

The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition… by Benjamin Graham, Jason Zweig

ISBN: 978–0060555665

The General Theory Of Employment, Interest, And Money by John Maynard Keynes

ISBN: 978–1467934923

The People v. Clarence Darrow: The Bribery Trial of America’s Greatest Lawyer by Geoffrey Cowan

ISBN: 978–0812963618

A Piece of the Action: How the Middle Class Joined the Money Class by Joe Nocera

ISBN: 978–1476744896

Money Masters of Our Time by John Train

ISBN: 978–0887309700

Paths to Wealth Through Common Stocks by Philip A. Fisher and Kenneth L. Fisher

ISBN-13: 978–0470139493

The Science of Hitting by Ted Williams, John Underwood and Robert Cup

ISBN: 978–0671621032

Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company by Andrew S. Grove

ISBN: 978–0385483827

The New Quotable Einstein by Alice Calaprice, Freeman Dyson and Albert Einstein

ISBN: 978–0691120751

The Farmer from Merna: A Biography of George J. Mecherle and a History of the State Farm Insurance Companies of… by Karl Schriftgiesser

ISBN: 978–0812984347

THEN:

Remember to mention, in a thoughtful and smart way, your admiration for the United States, the Free Enterprise, Omaha, the Cheeseburger, GEICO, Babe Ruth (the Bambino), and Warren’s massive ironclad pecuniary contribution to Bill & Melinda Gates Foundation, as well as the opportunities that this non-for-profit non-governmental organization offers, with the express end to solve intractable problems in the developing world.

(19.- of 20).- If you want to seize the undivided attention of top executives at Microsoft Corporation, TALK TO THEM THROUGH THE NOTIONS OF AND BY Bill Gates. Don’t tall to them about their omnipresent products and services. To this company particles and sub-particles count so much. Why? Because Microsoft is the granularity-of-detail multinational.

And Microsoft is accustomed to make baby steps at light-speed frequently, all of the time, hugely adhering to the practical implications of the Japanese Kaizen philosophy.

IF YOU COULD EXPRESS YOUR IDEAS IN ADVANCED COMPUTER PROGRAM CODING EXPRESSIONS, YOU WILL HAVE, AT THE OUTSET, THE BATTLE WON AT A PROPORTION OF 81%.

Tell them that the advice by Bill below, mired in Microsoft, has changed your life.

ENSUING:

ADVICE ONE

“… Success is a lousy teacher. It seduces smart people into thinking they can’t lose …”

ADVICE TWO

“… It’s fine to celebrate success but it is more important to heed the lessons of failure …”

ADVICE THREE

“… As we look ahead into the next century, leaders will be those who empower others …”

ADVICE FOUR

“… I believe in innovation and that the way you get innovation is you fund research and you learn the basic facts …”

ADVICE FIVE

“… You may have heard of Black Friday and Cyber Monday. There’s another day you might want to know about: Giving Tuesday. The idea is pretty straightforward. On the Tuesday after Thanksgiving, shoppers take a break from their gift-buying and donate what they can to charity …”

ADVICE SIX

“… Information technology and business are becoming inextricably interwoven. I don’t think anybody can talk meaningfully about one without the talking about the other …”

ADVICE SEVEN

“… The way to be successful in the software world is to come up with breakthrough software, and so whether it’s Microsoft Office or Windows, its pushing that forward. New ideas, surprising the marketplace, so good engineering and good business are one in the same …”

Absorb the preceding and incorporate those in your lexicon to them.

ALSO EXPRESS TO MICROSOFT EXECS THAT YOU REALLY APPRECIATE THEIR PHILOSOPHY WHEN THE OBSERVE:

“ … Our strategy: High-value activities enabled by a family of devices and services [….] To increase innovation, capability, efficiency and speed we further sharpened our strategy, and in July 2013 we announced we are rallying behind a single strategy as One Microsoft. We declared that Microsoft’s focus going forward will be to create a family of devices and services for individuals and businesses that empower people around the globe at home, at work and on the go, for the activities they value most. [….] Over time, our focus on high-value activities will generate amazing innovation and new areas of growth. What is a high-value activity? Think of the experiences people have every day that are most important to them — from communicating with a family member and researching a term paper to having serious fun and expressing ideas. In a business setting, high-value activities include experiences such as conducting meetings with colleagues in multiple locations, gaining insight from massive amounts of data and information, and interacting with customers [….] MOVING FORWARD. With the decisions we’ve made this year, the strategy we’ve put in place, the organization we’ve designed, the world-class talent we have, and the devices and services we are creating, we are well-positioned to deliver growth and world-changing technology long into the future [….] We have seen incredible results in the past decade — delivering more than $200 billion in operating profit [….] Microsoft is now your ‘devices and services’ company…”

Bill Gates is no more the Microsoft chairman, but his influence on this firm is, at all times, huge. Using the words of the books below, speak to Microsoft also quoting:

Business @ the Speed of Thought: Succeeding in the Digital Economy (ISBN: 978–0446525688)

The Road Ahead: Completely Revised and Up-to-Date by Bill Gates, Nathan Myhrvold and Peter Rinearson

ISBN: 978–0140260403

Business Adventures: Twelve Classic Tales from the World of Wall Street by John Brooks

ISBN-13: 978–1497644892

Stress Test: Reflections on Financial Crises by Timothy F. Geithner

ISBN-13: 978–0804138598

The Bully Pulpit: Theodore Roosevelt, William Howard Taft, and the Golden Age of Journalism by Doris Kearns Goodwin

ISBN-13: 978–1416547877

The Rosie Project: A Novel, by Graeme Simsion.

ISBN-13: 978–1476729091

The Sixth Extinction: An Unnatural History by Elizabeth Kolbert

ISBN-13: 978–0805092998

Reinventing American Health Care: How the Affordable Care Act will Improve our Terribly Complex, Blatantly Unjust… by Ezekiel Emanuel

IN YOUR DEALINGS WITH MICROSOFT, PAY, AS WELL, TRIBUTE TO MR. PAUL GARDNER ALLEN.

And to this end, beyond Paul’s greatest philanthropic activities, remember this, too:

Idea Man: A Memoir by the Co-founder of Microsoft by Paul Allen (ISBN: 978–1591845379).

AFTER ALL, do not get yourself confounded, Microsoft is not just a super-advanced hi-tech, but a formidable player into Strong Artificial Intelligence with a plausible sweet tooth, in due time, for Quantum Supercomputing.

FINAL CONSIDERATIONS ON MICROSOFT TO KEEP IN MIND. PAY HEED TO THESE CRUCIAL RANDOM TEXTS:

TEXT ONE.

”… As the boss (Bill Gates) of Microsoft, the world’s most successful software company, I played a large part in the birth of the Information Age. In this book I explain the idea of a digital nervous system—the use of information technology to satisfy people’s needs at work and at home … ”

TEXT TWO.

“… In 1999 Bill Gates wrote a prophetic book titled ‘…Business @ The Speed of Thought: Using a Digital Nervous System,…: where he stated in the very first chapter: ‘…I have a simple but strong belief. The most meaningful way to differentiate your company from your competition, the best way to put distance between you and the crowd, is to do an outstanding job with information. How you gather, manage and use information will determine whether you win or lose… The relentless onward march of advanced digital technology in dentistry is a fact of life in managing a dental practice,

and it is undeniably true that how we ‘…gather, manage and use information will determine whether you win or lose…’.…”

TEXT THREE.

“…I [Bill Gates] work in the software industry, where change is the norm. A popular software title…gets upgraded every year or two with major new features and continuous refinements [Kaizen]. We listen to customer feedback and study new technology opportunities to determine the improvements to make …” Brackets of and by the author.

TEXT FOUR.

“…The most important part of my [Bill Gates’] work as chairman is recognizing [sea-changes] and articulating the opportunities they present to each person in the company. We then empower employees with as much information and as many productivity tools as possible, so they can achieve results within the framework of that vision …” Brackets of and by unknown author.

TEXT FIVE.

“ … Microsoft, gives readers a fascinating insight into how personal computers are in the future going to change our lives still further and how the Internet will continue to evolve. Optimistic and enthusiastic, Bill Gates takes the reader into a world of the near future. This is a world where less paper is used [a digitized one], where teachers share their work and reach more students, where businesses hold meetings across the world without anyone leaving their offices, and where someone’s house can recognize them and choose their favorite music as they enter …”

AND REMEMBER, BOTH NOKIA AND SKYPE BELONG TO MICROSOFT.

LET THE MICROSOFT EXECUTIVES, THAT YOUR LIFE WAS NEVER THE SAME AND GOT TRANSFORMED BY READING THIS BY BILL:

“ … I wrote my first program for a computer when I was thirteen years old. A program tells a computer to do something. My program told the computer to play a game. This computer was very big and very slow. It didn’t even have a computer screen. But I thought it was wonderful. I was just a kid, but the computer did everything I told it to do. And even today, that’s what I love about computers. When I write a good program, it always works perfectly, every time …”

(20.- of 20).- If you want to seize the undivided attention of top executives at APPLE INC., TALK TO THEM THROUGH THE NOTIONS OF AND BY industrial design with applied fine arts, engineering, novelty, and rampant perfectionism, with the utter purpose to achieve grandiose products and high-end services, as well as the wisdom below.

I am going to share with you the wisest tidbits by apple founder, with the utter objective to convey you from a deeper understanding into doing some serious business with this great American global corporation. Pay attention; You have been warned!

Remember that Apple is hugely into a purposeful dynamic narrative with its many customers and hence into outright storytelling.

ENSUING:

WISE TIDBITS BEGIN NOW:

“ … Your time is limited, so don’t waste it living someone else’s life. Don’t be trapped by dogma — which is living with the results of other people’s thinking. Don’t let the noise of others’ opinions drown out your own inner voice. And most important, have the courage to follow your heart and intuition.__[.…]__ Everyone here has the sense that right now is one of those moments when we are influencing the future.__[.…]__For the past 33 years, I have looked in the mirror every morning and asked myself: ‘If today were the last day of my life, would I want to do what I am about to do today?’ And whenever the answer has been ‘No’ for too many days in a row, I know I need to change something.__[.…]__You can’t connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future. You have to trust in something — your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life.__[.…]__Innovation distinguishes between a leader and a follower.__[.…]__My favorite things in life don’t cost any money. It’s really clear that the most precious resource we all have is time.__[.…]__Be a yardstick of quality. Some people aren’t used to an environment where excellence is expected.__[.…]__Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do. If you haven’t found it yet, keep looking. Don’t settle. As with all matters of the heart, you’ll know when you find it.__[.…]__Design is not just what it looks like and feels like. Design is how it works.__[.…]__That’s been one of my mantras — focus and simplicity. Simple can be harder than complex: You have to work hard to get your thinking clean to make it simple. But it’s worth it in the end because once you get there, you can move mountains.__[.…]__ Creativity is just connecting things. When you ask creative people how they did something, they feel a little guilty because they didn’t really do it, they just saw something. It seemed obvious to them after a while. That’s because they were able to connect experiences they’ve had and synthesize new things.__[.…]__ Sometimes when you innovate, you make mistakes. It is best to admit them quickly, and get on with improving your other innovations.__[.…]__Design is a funny word. Some people think design means how it looks. But of course, if you dig deeper, it’s really how it works.__[.…]__Technology is nothing. What’s important is that you have a faith in people, that they’re basically good and smart, and if you give them tools, they’ll do wonderful things with them.__[.…]__Stay hungry, stay foolish.__[.…]__Computers themselves, and software yet to be developed, will revolutionize the way we learn.__[.…]__Design is the fundamental soul of a man-made creation that ends up expressing itself in successive outer layers of the product or service. The iMac is not just the color or translucence or the shape of the shell. The essence of the iMac is to be the finest possible consumer computer in which each element plays together.__[.…]__The over-all point is that new technology will not necessarily replace old technology, but it will date it. By definition. Eventually, it will replace it. But it’s like people who had black-and-white TVs when color came out. They eventually decided whether or not the new technology was worth the investment.__[.…]__I have a great respect for incremental improvement, and I’ve done that sort of thing in my life, but I’ve always been attracted to the more revolutionary changes. I don’t know why. Because they’re harder. They’re much more stressful emotionally. And you usually go through a period where everybody tells you that you’ve completely failed.__[.…]__If you haven’t found it yet, keep looking. Don’t settle …”

WISE TIDBITS END NOW.

Check some of the fundamental of their organizational ethos and values:

SOME ORGANIZATIONAL ETHOS AND VALUES BEGIN:

WE BELIEVE EDUCATION CAN EMPOWER WORKERS AND IMPROVE LIVES.

Because education is a great equalizer, we’re investing heavily in helping workers throughout our supply chain learn new skills and better understand their rights. In 2013, more than 280,000 people at 18 supplier sites took courses in a range of subjects through our free education and development program. In addition, our suppliers trained more than 1.5 million workers on their rights, bringing the total number trained since 2007 to 3.8 million.

WE’VE STRENGTHENED OUR PROGRAMS TO HELP SUPPLIERS PROTECT STUDENT INTERNS AND OTHER AT-RISK WORKERS. We’re continuing our efforts to end excessive work hours. In 2013, our suppliers achieved an average of 95 percent compliance with our maximum 60-hour workweek. We’re driving responsible sourcing of minerals, and we’ve publicly released a list of smelters and refiners in our supply chain to promote transparency.

TO ADDRESS THE SHORTAGE OF QUALIFIED ENVIRONMENT, HEALTH, AND SAFETY (EHS) PERSONNEL, we launched the Apple Supplier EHS Academy — a formal, 18-month program we believe to be one of the most comprehensive EHS training and education programs in any supply chain. In 2013, over 240 factory personnel representing factories with more than 270,000 employees enrolled in this program, which will raise the standard for EHS management in our supply chain.

WE EXPECT OUR SUPPLIERS TO ACT IN ENVIRONMENTALLY RESPONSIBLE WAYS. So we’re working with industry experts to identify high-risk facilities, conduct audits focused on environmental issues, and develop methods to lessen our environmental impact. In addition, we launched a pilot of our Clean Water Program with sites that collectively use over 41 million cubic meters of water per year. We have aggressive goals to reduce freshwater usage by reusing and recycling water within the production process.

OUR SUPPLIER CODE OF CONDUCT WAS ALREADY ONE OF THE TOUGHEST IN THE ELECTRONICS INDUSTRY, but we’ve made it even stronger. And we ensure compliance by conducting hundreds of audits per year worldwide. Our efforts span the entire range of our supply chain — from the manufacturers of tiny components to the facilities that assemble our final products.

GET DETAILED INFORMATION ABOUT OUR 18 FINAL ASSEMBLY FACILITIES. And download a list of our top 200 suppliers, including component providers and others representing at least 97 percent of procurement expenditures for materials, manufacturing, and assembly of our products worldwide in 2013.

SOME ORGANIZATIONAL ETHOS AND VALUES END.

And leading people at Apple Inc. suggest this reading list.

READING LIST BEGINS:

Atlas Shrugged by Ayn Rand and Leonard Peikoff (Aug 1, 1999)

ISBN-13: 978–0452011878

The Innovator’s Dilemma: The Revolutionary Book That Will Change the Way You Do Business by Clayton M. Christensen

ISBN-13: 978–0062060242

Be Here Now by Ram Dass (Oct 12, 1971)

ISBN-13: 978–0517543054

Zen Mind, Beginner’s Mind by Shunryu Suzuki and David Chadwick (Jun 28, 2011)

ISBN-13: 978–1590308493

Autobiography of a Yogi (Self-Realization Fellowship) by Paramahansa Yogananda (Jan 5, 1998)

ISBN-13: 978–0876120798

Diet for a Small Planet (20th Anniversary Edition) by Frances Moore Lappe (May 12, 1985)

ISBN-13: 978–0345321206

Inside the Tornado: Strategies for Developing, Leveraging, and Surviving Hypergrowth Markets (Collins Business… by Geoffrey A. Moore (Dec 14, 2004)

ISBN-13: 978–0060745813

Cutting Through Spiritual Materialism (Shambhala Classics) by Chogyam Trungpa (Oct 22, 2002)

ISBN-13: 978–1570629570

Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company by Andrew S. Grove (Mar 16, 1999)

ISBN-13: 978–0385483827

iWoz: Computer Geek to Cult Icon: How I Invented the Personal Computer, Co-Founded Apple, and Had Fun Doing It… by Steve Wozniak and Gina Smith (Oct 17, 2007)

ISBN-13: 978–0393330434

READING LIST ENDS.

NOW, CONCLUDING THIS WRITING:

N.B. #1: If anything of the Institutions above has a major proprietary Methodology or Problem-Solving Methodology to fundamentally tackle with Issue A, Issue B, and Issue C, and in case that you ALSO have your own major proprietary Methodology or Problem-Solving Methodology to fundamentally tackle with Challenge Alpha, Challenge Beta, and Challenge Gamma — to the greatest competitive advantage of the Institutions above —, DO NOT EVER EVER MAKE DIRECT OR INDIRECT COMPARISSONS.

AND NEVER EVER UNDERMINE OR TALK ABOUT THEIR METHODOLOGIES OR SYSTEMS IN A DISFAVORABLE WAY.

If you have to, go all the way to acknowledge their solution tool-kits frequently and get busied doing yours without offending anyone. Be extremely carefully.

N.B. #2: I know great c-suite consulting incumbents and other professional service providers who want to get the undivided attention of 90% of the CEOs above at once.

The majority of those CEOs are august applied scientists. They are only into applied scientific management. Ergo, they really need to get ready to be multidimensional and cross-functional and multifarious.

There is NEVER EVER an Internet resource, nor an online book or article giving you this most-profound advice.

AND TO CONCLUDE THIS WORK, I WILL TELL YOU NOW SEVERAL THINGS ABOUT “…GOOD LUCK…” AND “…BAD FORTUNE…”

ENSUING:

TO GOOD-LUCK OR NOT TO BAD-LUCK, WHAT IS, AS PER OUTRIGHT ROCKET SCIENCE, THE UNFAILING QUESTION BEYOND SUPERSTITION, IGNORANCE, AND MENTAL LAZINESS?

BAD LUCK?

In outright — most seriously — hard rocket science, there is not Bad Luck, but an unfavorable situation and negative dynamics, whose detailed circumstances are NOT FULLY understood, but with deep and wide knowledge can be transformed to our advantage.

GOOD LUCK?

In outright — most seriously — hard rocket science, there is not Good Luck, but a favorable situation and positive dynamics, whose detailed circumstances are NOT FULLY understood, but with deep and wide knowledge can be transformed to our advantage.

BAD FORTUNE?

In outright — most seriously — hard rocket science, there is not Bad Fortune, but an unfavorable situation and negative dynamics, whose detailed circumstances are NOT FULLY understood, but with deep and wide knowledge can be transformed to our advantage.

GOOD FORTUNE?

In outright — most seriously — hard rocket science, there is not Good Fortune, but a favorable situation and positive dynamics, whose detailed circumstance are NOT FULLY understood, but with deep and wide knowledge can be transformed to our advantage.

UNDERSTANDING BAD LUCK AND BAD FORTUNE?

Accordingly, you can say that Bad Luck and Bad Fortune ARE A FUNCTION OF having an unprepared mind and hence being sputnikked (strategically surprised into immeasurable disruption) by the rigors and rudiments of professional life, hence undergoing one’s own all crucial NEGATIVE disadvantages by carelessness.

UNDERSTANDING GOOD LUCK AND GOOD FORTUNE?

Consequently, you can say that Good Luck and Good Fortune ARE A FUNCTION OF having an industriously prepared mind READY IN REAL-TIME and NEVER EVER being sputnikked. Thus, NEVER EVER strategically surprised into immeasurable disruption, but, on the contrary, into overwhelming Continual Victory and Nonlinear Exponential Growth.

COMMENTARY NUMBER 1:

To underpin the above, let us consider this wise quotation:

“ … ALL OF US WILL NEED MORE THAN LUCK TO SUCCEED AND EXCEL IN THIS NEW, FASTER-PACED WORLD …” (ISBN: 978–1137279552).

COMMENTARY NUMBER 2:

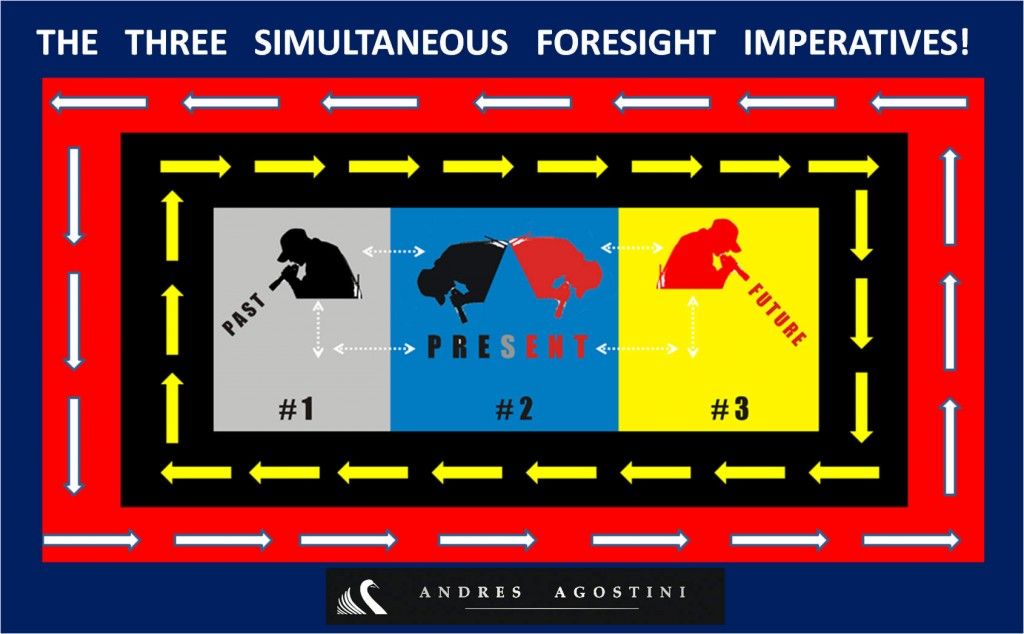

Imagine that you start rowing in one direction. The left behind trail (the past) and the trajectory projected forward (the future), by yourself, of one own rowing effort in order to seize your Continual Success and keep seizing you Continual Success and your Increasing Growth.

Blind followers of Bad Luck and Good Fortune, so called, DO NOT follow strict Science. And Science entails the Great Observance of Laws of Nature and Laws of the Universe, never guesswork!

COMMENTARY NUMBER 3:

Stop the superstition and ignorance, become a master and get over-prepared, by preparing your won self. PREPARATION IS A SINE QUA NON INDISPENSABLY HERE.

Subsequently, practice, practice, and practice your preparation. And always remember:

“… Practice makes perfect …”

Authored By Copyright Mr. Andres Agostini

White Swan Book Author (Source of this Article)

www.LINKEDIN.com/in/andresagostini

www.AMAZON.com/author/agostini

www.appearoo.com/aagostini

@AndresAgostini