Archive for the ‘finance’ category: Page 125

Nov 20, 2017

Christiana Figueres Europe Regional Round Table—United Nations Environment Programme Finance Initiative (UNEP FI)

Posted by Odette Bohr Dienel in categories: environmental, finance, governance, innovation, policy, sustainability

“Former Executive Secretary to UNFCCC, Christiana Figueres has laid down a challenge to UNEP FI’s banking members, and the wider finance industry to increase their allocations to low carbon investments to avoid a 2 degrees scenario. Watch her recording which she made for participants at UNEP FI’s Europe Regional Roundtable on Sustainable Finance which took place in October 2017.”

Tag: Banking

Nov 20, 2017

Al Gore — Fiduciary Duty in the 21st century—Principles for Responsible Investment (PRI)

Posted by Odette Bohr Dienel in categories: business, economics, environmental, finance, governance, sustainability

“Former Vice President and Chairman of Generation Investment Management, Al Gore, introduces PRI, UNEP FI and The Generation Foundation’s Fiduciary duty in the 21st century programme. The project finds that, far from being a barrier, there are positive duties to integrate environmental, social and governance factors in investment processes.”

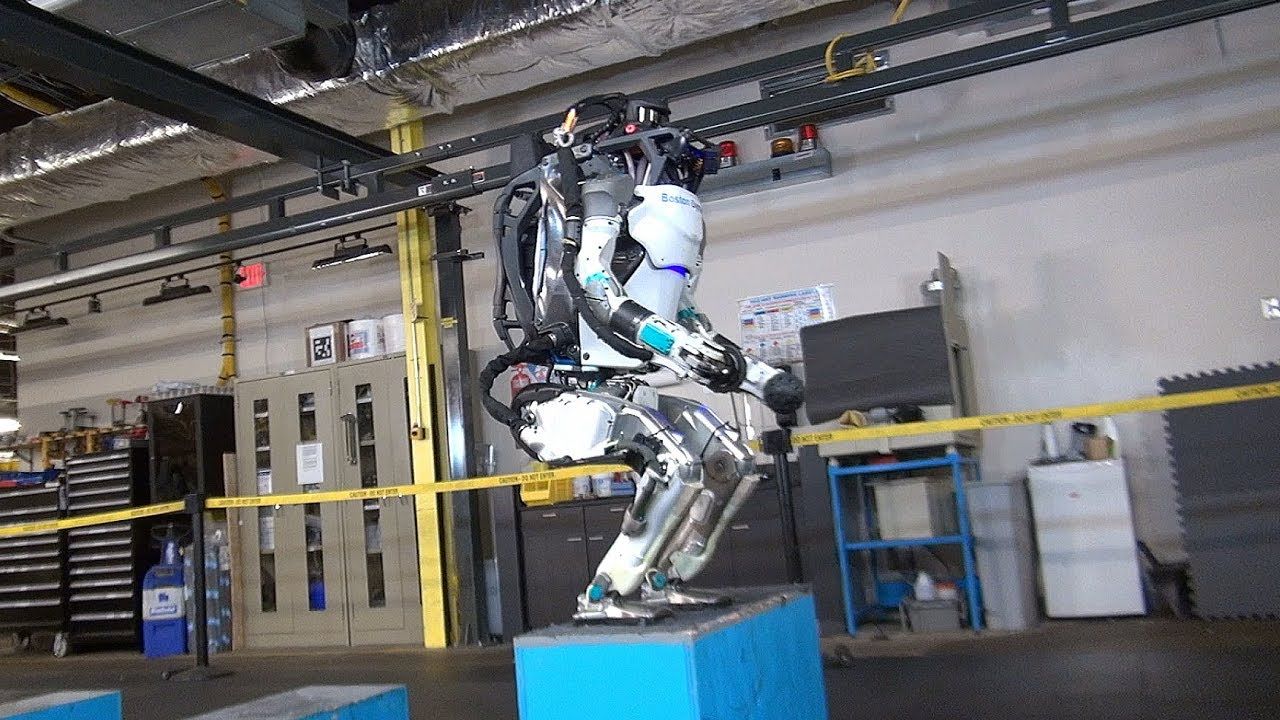

They taught ATLAS Kung Fu 😮

Really impressive, only things that need to be worked on. Shrink the Torso A Lot, so it’s comparable to a person. And, someone is going to have finance coming up with a set of robotic human like hands.

Nov 15, 2017

Richest 1% own half the world’s wealth, study finds

Posted by Derick Lee in category: finance

The world’s richest people have seen their share of the globe’s total wealth increase from 42.5% at the height of the 2008 financial crisis to 50.1% in 2017, or $140tn (£106tn), according to Credit Suisse’s global wealth report published on Tuesday.

At the other end of the spectrum, the world’s 3.5 billion poorest adults each have assets of less than $10,000 (£7,600). Collectively these people, who account for 70% of the world’s working age population, account for just 2.7% of global wealth.

Credit Suisse report highlights increasing gap between the super-rich and the remainder of the globe’s population.

Continue reading “Richest 1% own half the world’s wealth, study finds” »

Nov 2, 2017

Renewables Are Starting to Crush Aging U.S. Nukes, Coal Plants

Posted by Dan Kummer in categories: energy, finance

Building solar and wind farms has started to become a cheaper proposition than running aging coal and nuclear generators in parts of the U.S., according to financial adviser Lazard Ltd.

Nov 1, 2017

The robot lawyers are here and winning

Posted by Amnon H. Eden in categories: finance, law, robotics/AI

Artificial intelligence beats over 100 London lawyers in predicting case outcome:

In a contest that took place last month. It pitched over 100 lawyers from many of London’s ritziest firms against an artificial intelligence program called Case Cruncher Alpha.

Both the humans and the AI were given the basic facts of hundreds of PPI (payment protection insurance) mis-selling cases and asked to predict whether the Financial Ombudsman would allow a claim.

Oct 25, 2017

Google moon shot stands to give industrial 3D printing a boost

Posted by Klaus Baldauf in categories: 3D printing, finance, robotics/AI, space travel

In what promises to be one small step for space travel, and one giant leap for the next generation of manufacturing, an Israeli startup is planning to land a vehicle on the moon that has crucial parts made using 3D printing technology.

SpaceIL is among five teams vying for Google’s $30 million in prize money to get a spacecraft to the moon by the end of March. One of the startup’s suppliers, Zurich-based RUAG Space, advised turning to 3D printing to manufacture the legs of its unmanned lunar lander. With financial stakes high and a tight deadline, SpaceIL engineers were at first deeply skeptical, according to RUAG executive Franck Mouriaux. They finally acquiesced after a lot of convincing.

Oct 15, 2017

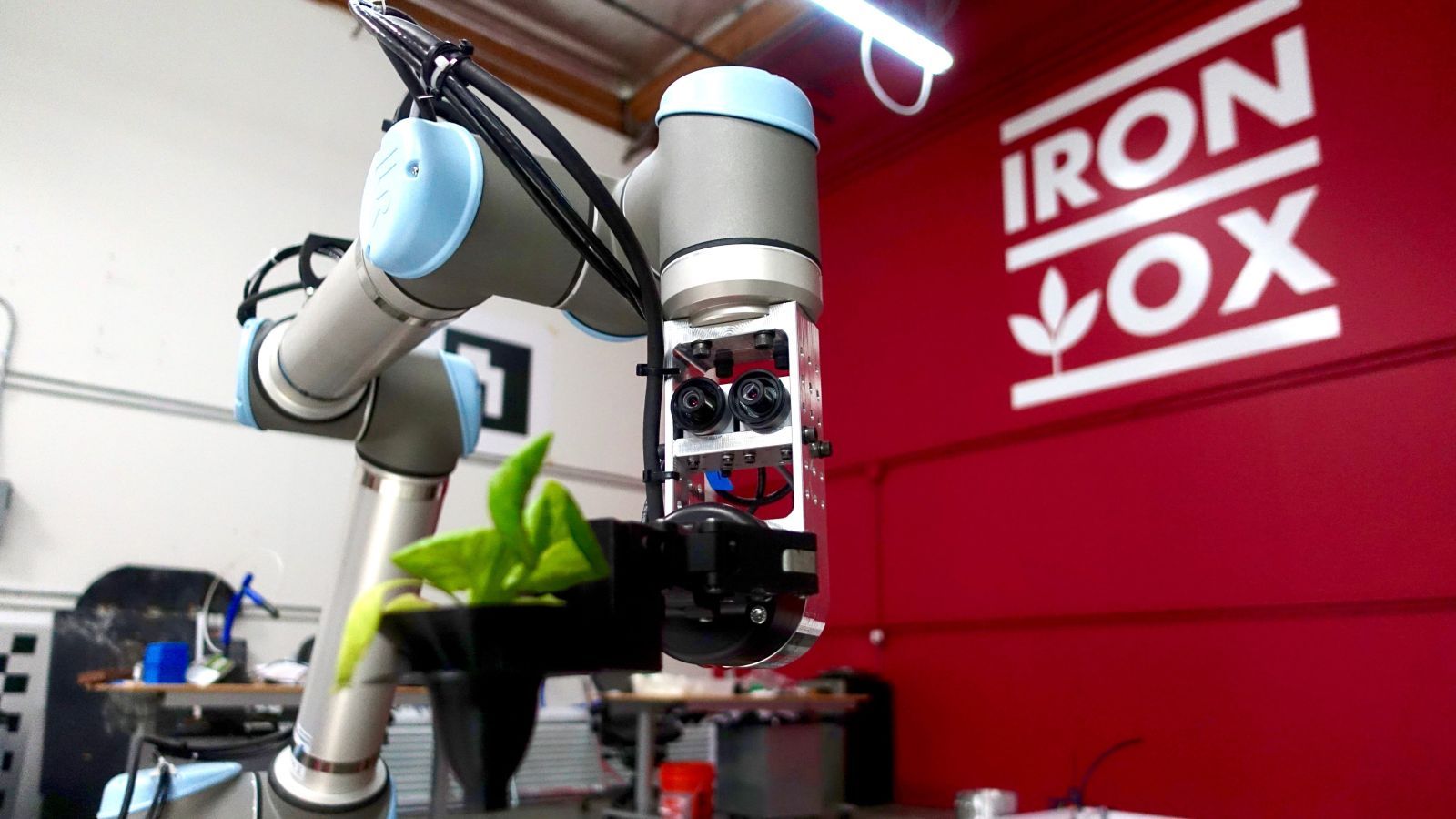

Startup Iron Ox is developing small farms in suburbia that will be run by robots

Posted by Dan Kummer in categories: finance, food, habitats, robotics/AI, sustainability

You could drive past and never see the only farm in San Carlos, California. The tiny city of 30,000 that sits between San Francisco and Silicon Valley has all the charms of suburbia—sprawling office parks and single-story homes—but doesn’t seem a likely suspect for agriculture.

The farm, run by startup Iron Ox, is nestled between three stonemasons and a plumber in a nondescript office park building; there’s no greenhouse, no rows of freshly-tilled soil, or tractor parked outside. Only peeking in the large bay door reveals the building’s tenants: a few hundred plants and two brightly-colored robot farmers.

Iron Ox looks a lot like a tech company. One of its co-founder is an ex-Google engineer and it raised $1.5 million in pre-seed venture capital from Y Combinator, Pathbreaker, and Cherubic Ventures in April 2016. Instead of fake food, or plant-based meat meals, or even a food delivery service tethered to an app, Iron Ox is reinventing farming, raising real, not faux, food. Think hydroponically raised lettuce and basil, like what you’d get at an ordinary farmers market.

Oct 6, 2017

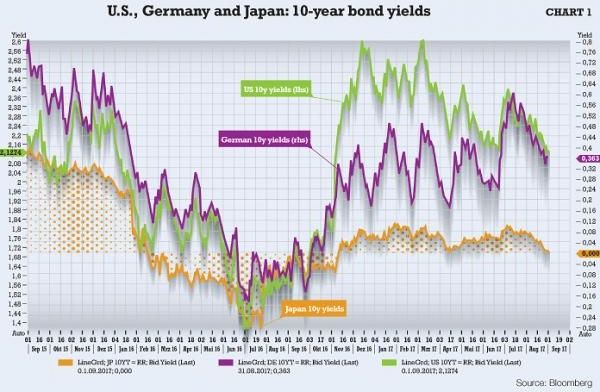

No Inflation? Technology May Have Left it Back in the 20th Century

Posted by Derick Lee in categories: economics, finance, robotics/AI

These are a tiny fraction of the examples of how our economy differs from the 20th century industrial economy. Similar changes are under way in the developing world, as labor gives way to robotics and basic goods become affordable and accessible to the planet’s billions. Given those changes, why would 20th century models of prices and rates and money supply work as they used to work?

We like to believe that there are “laws of economics” and past patterns to guide us, but, as Yellen indicated, there is now “considerable uncertainty.” It may feel safer to trust that past patterns will reassert themselves. But maybe policymakers should weigh more heavily the chance that the patterns have changed.

The Federal Reserve takes a 20th-century approach to managing a 21st-century economy.

Continue reading “No Inflation? Technology May Have Left it Back in the 20th Century” »