Feb 3, 2014

The Future Observatory

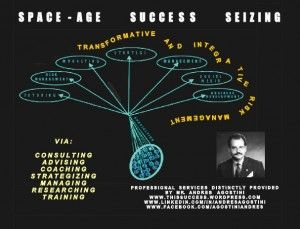

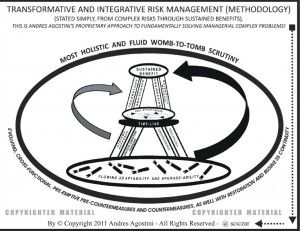

Posted by Andres Agostini in categories: 3D printing, automation, big data, biological, bionic, bioprinting, biotech/medical, bitcoin, business, chemistry, climatology, complex systems, computing, cosmology, counterterrorism, cybercrime/malcode, cyborgs, defense, driverless cars, drones, economics, education, energy, engineering, entertainment, environmental, ethics, events, existential risks, exoskeleton, finance, food, futurism, general relativity, genetics, geopolitics, government, habitats, hardware, health, human trajectories, information science, innovation, law, life extension, military, mobile phones, nanotechnology, neuroscience, nuclear energy, nuclear weapons, open access, open source, particle physics, philosophy, physics, policy, polls, posthumanism, privacy, rants, robotics/AI, science, scientific freedom, security, singularity, space, supercomputing, surveillance, sustainability, transhumanism, transparency, transportation, treaties, water

FEBRUARY 04/2014 UPDATES. By Mr. Andres Agostini at www.Future-Observatory.blogspot.com

Lockheed Uses Robot Arm To Build F-35s

http://www.popsci.com/article/technology/lockheed-uses-robot…SOC&dom=fb

New Method of Creating Stem Cells is a “Game Changer”

http://blogs.discovermagazine.com/d-brief/2014/01/30/new-met…u7rhLTSmHd

The Future of Skunkworks Management to Impossible Business Enterprises

http://lnkd.in/bYP2nDC

Was There A Beginning Of Time And Will There Be An End Of Time?

http://www.messagetoeagle.com/timeslowingdown.php?utm_source…u7yMbTSmHd

by

by