Jan 6, 2021

The world’s first integrated quantum communication network

Posted by Genevieve Klien in categories: encryption, energy, finance, quantum physics, satellites

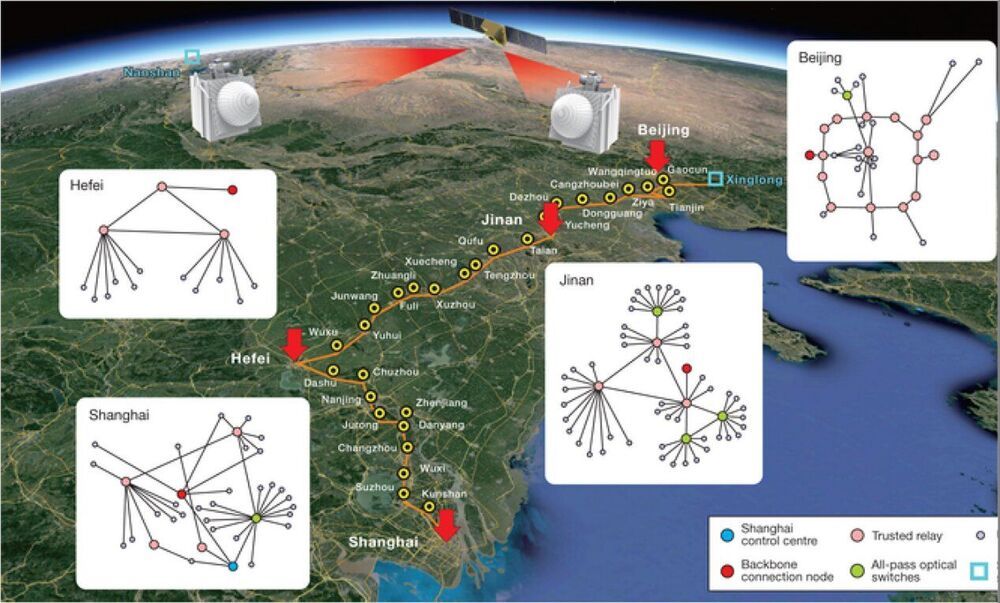

Chinese scientists have established the world’s first integrated quantum communication network, combining over 700 optical fibers on the ground with two ground-to-satellite links to achieve quantum key distribution over a total distance of 4600 kilometers for users across the country. The team, led by Jianwei Pan, Yuao Chen, Chengzhi Peng from the University of Science and Technology of China in Hefei, reported in Nature their latest advances towards the global, practical application of such a network for future communications.

Unlike conventional encryption, quantum communication is considered unhackable and therefore the future of secure information transfer for banks, power grids and other sectors. The core of quantum communication is quantum key distribution (QKD), which uses the quantum states of particles—e.g. photons—to form a string of zeros and ones, while any eavesdropping between the sender and the receiver will change this string or key and be noticed immediately. So far, the most common QKD technology uses optical fibers for transmissions over several hundred kilometers, with high stability but considerable channel loss. Another major QKD technology uses the free space between satellites and ground stations for thousand-kilometer-level transmissions. In 2016, China launched the world’s first quantum communication satellite (QUESS, or Mozi/Micius) and achieved QKD with two ground stations which are 2600 km apart.